Retail industry experts have promulgated the idea that the pandemic and subsequent lockdowns simply sped up the inevitable demise of shopping centers, malls and retailers that for years had struggled to survive. It also could be said that the health crisis has accelerated another trend that was gaining momentum: establishing last-mile e-commerce logistics hubs at shopping centers.

In early September, Amazon and mall owner Simon Property Group reportedly began exploring the idea of turning some of Simon’s empty J.C. Penny and Sears stores into fulfillment centers.

Later that month, JLL launched its Retail Industrial Task Force, a blended service model catering to retail property owners, tenants and investors to convert unneeded or obsolete shopping center space into distribution centers, among other retail, logistics and development assistance.

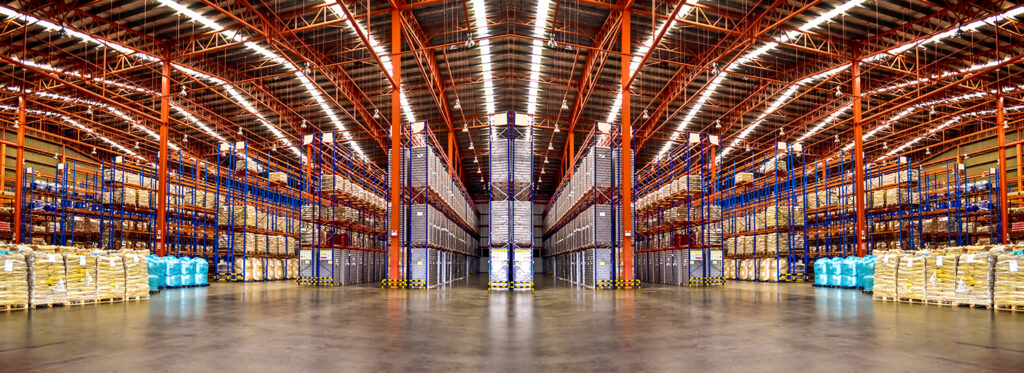

“Dark stores or vacancies often present an ideal opportunity for last-mile fulfillment center conversions, especially as e-commerce delivery competition continues to grow,” said Naveen Jaggi, president of retail advisory services for the Americas at JLL, in a statement. He added that conversions require an understanding of the capital markets environment and how institutional investors value assets. The conversion concept is particularly appealing in high-density urban environments where demand is highest, JLL officials noted, while nationally the average industrial vacancy rate is less than 4 percent.

The retail-to-industrial conversion idea is not new. Amid the growing list of shuttered malls and rising e-commerce sales over the last several years, retail real estate and land use experts have suggested that some of the properties could be repurposed as industrial sites, and it appears to be happening. CBRE reported that since 2017, developers in the U.S. have turned some 13.8 million square feet of dead malls and other underutilized retail space into 15.5 million square feet of last-mile distribution centers.

One developer aims to tie retail to industrial in a different way. ShopFulfill, a startup founded by New York-based real estate investor Shlomo Chopp, is launching Anchor Shops, a new concept that places growing online retailers in a traditional brick-and-mortar environment while providing on-site logistics space and services. Key to the operation, Anchor Shops will provide tenants with a range of turnkey services. Retailers will share staff, warehousing and transportation services, for example, and will use the distribution space as a backroom to stock their shelves at the property and to pre-position its products for local delivery.

“The reimagining of retail is not as simple as coming up with one idea that fits all. What’s going to solve it involves many components, and of those is Anchor Shops,” said Chopp, who also provides commercial property loan restructurings and workouts. “We’re creating a phased growth process where we can take small brands and grow them into traditional retailers, but traditional retailers that have an infrastructure to support them.”

Creating a connection to customers is a key component of the Anchor Shops strategy. Typically, small retailers can’t justify the cost of opening, staffing and supplying local stores. Instead they sell their goods through a general retailer or department store, but they lose a direct connection to their customers, Chopp said. Establishing a physical presence will help build those connections, he added.

Anchor Shops will also employ a complementary merchandising approach to target specific types of customers and promote cross-shopping. Shoppers will check out at a central counter, and when receipts are divvied up at the end of the day, retailers will be able to see the details of their customers’ entire shopping trip.

“Retailers won’t have the burden of operating a store but will have smooth interplay between brands – not only are other brands helping you make a sale, but you’re also helping other brands make a sale,” Chopp said. “The strategy goes to the core issue of, ‘How do I create sales in the store, how do I use the store to create more online sales, and frankly, how do I use additional online channels to drive people to the store to generate higher margin sales?’”

Originally ShopFulfill expected to begin opening Anchor Shops locations in Philadelphia and southern New Jersey this year, but the lockdown changed those plans. Now the company intends to take advantage of the crisis by buying assets at a discount or recapitalizing and taking control of struggling properties. The company is looking for open-air lifestyle centers of 250,000 square feet or more where at least 40 percent of the space is vacant or severely underperforming.

“We have a path to acquisitions and are looking for properties that we can buy at the right price and turn around,” Chopp said. “It’s going to be a process, but we’re keeping a very close eye on opportunities.”

Whether looking for up-and-coming or longstanding brands to fill space in your retail property, Retailsphere can help you identify and contact tenants that can boost the complementary appeal of your tenant mix and lessen the risk of storefront vacancies. Schedule a no-obligation demo today and see how easy Retailsphere can make your tenant search.